As the world dives into the second quarter of 2023, inflation continues to make its presence felt, prompting discussions on whether 2022 was an anomaly or a return to normalcy. In his most recent webinar with the Institute of Mergers, Acquisitions, and Alliances (IMAA), finance expert Prof. Aswath Damodaran sheds light on the transformative impact the year 2022 had on financial markets and businesses, offering valuable insights on investment strategies in a challenging landscape and discussing what investors should look out for in 2023.

2022’s Unusual Asset Performance: A Bad Year for Stocks and the Worst Year for Bonds

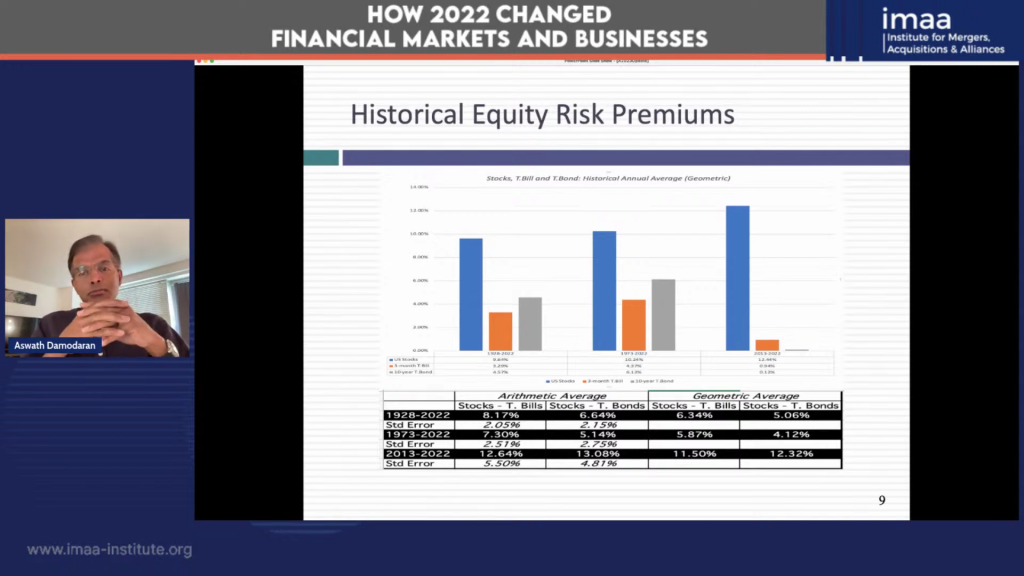

In the world of stocks, 2022 was marked by a turbulent ride. The S&P 500 Index experienced a mix of good months and bad months, with an overall price depreciation of 19.42% and a return on stocks of -18%. Aswath Damodaran’s insights reveal that this marked downturn in the market placed 2022 as the 7th worst year for stocks in the last century in nominal terms and the 6th worst in real terms. The repercussions of what occurred in 2022 was evident at the start of 2023 where early on it was implied that equity risk premium was 5.94%, with a significant one-year increase in expected returns from 5.75% to 9.82%, impacting companies’ investment decisions and valuations.

Though the stock market experienced what can be called a bad year, the bond market had its worst year in history. Government (T-bonds) reported a -17.8% nominal return and -23% real return, while corporate bonds plunged even further with a -24% nominal return and -31% real return. The inflation impact on financial markets fueled a climate of heightened risk, leading to an expansion of corporate bond default spreads across all rating classes. An unusual inversion was observed as the yield curve sloped downward due to short-term rates soaring beyond long-term rates.

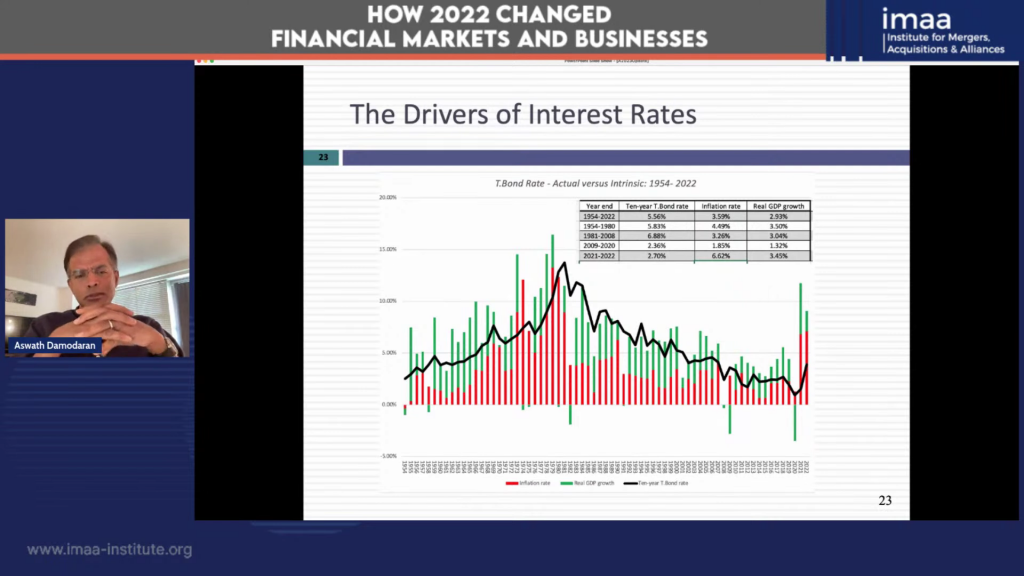

2022 broke the mold by presenting a dual downturn in both the stock and bond markets. This was an anomaly, as historically in the five most significant downturns of the stock market – years when the market plummeted by 25% or more – bonds typically managed to retain a positive return. This positive trend in bonds during stock crises was often fueled by a corresponding decline in T-bond rates, as evidenced in the 2008 financial crisis. However, 2022 deviated from this pattern, offering up a challenging landscape where both stocks and bonds stumbled. Now what was the key driving force behind this unusual downturn? Inflation.

The Impact of Inflation on Economic Recession and Asset Performance

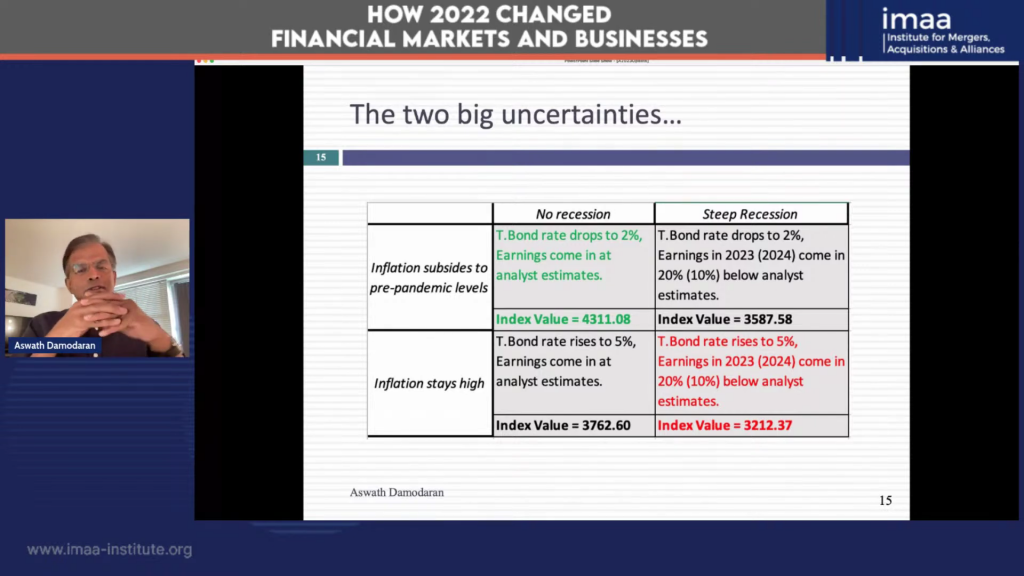

The surge of inflation in 2022 was the primary factor behind the rise in interest rates, casting shadows over both the stock and bond markets and giving rise to increased uncertainty and risk. This inflationary backdrop had intriguing implications for asset valuation. For instance, an assessment of the S&P 500’s intrinsic value at the onset of 2023 rendered a figure of 39.72, hinting that stocks were somewhat undervalued. However, the recovery of the stock market faced substantial headwinds. High inflation coupled with higher risk-free rates put equities on the back foot. Markets in 2023 continued to fluctuate, driven by shifting perspectives on inflation and the looming threat of an economic recession.

Beyond individual asset prices, inflation also profoundly reshaped broader market dynamics. The narrative of 2022 was characterized by the change in the cost of equity and equity risk premiums, which will likely continue to play out through 2023. Amidst this turbulent market landscape, market strategists’ predictions for S&P 500 were noted, but their accuracy as predictors remains questionable.

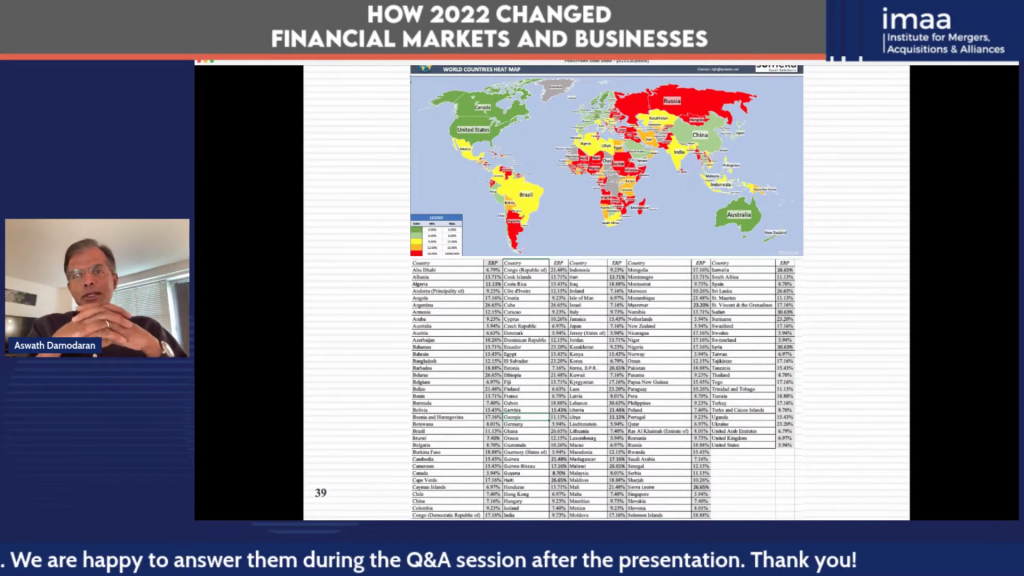

A Global Perspective: Country Risk and Equity Risk Premiums

Aswath Damodaran’s webinar extended beyond the US market to encompass a global perspective on financial risk, focusing on country risk and equity risk premiums. He discussed country risk as driven by four key drivers including political structure, levels of violence, corruption, and the enforcement of legal and property rights. The risk level associated with a country does not stand constant but varies according to its life cycle stages: higher risk in younger countries that face growth-related uncertainties, less risk for mature countries, while declining nations have a unique set of risks. Damodaran highlighted that these risks are not only relevant to investors looking at international markets but also to domestic investors, as companies doing business internationally expose their shareholders to country risk.

Transitioning into the broader economic environment, Professor Damodaran’s insights delved into the implications of inflation on risk-free rates. The start of 2023 saw risk-free rates fluctuate across different currencies, primarily driven by their respective inflation rates. High inflation correlated with higher risk-free rates, while lower inflation corresponded with lower rates. Drawing on this, Prof. Damodaran elaborated on the connection between inflation and equity risk premiums, a metric he argues is crucial for understanding a country’s investment risk profile. He noted that the US equity risk premium was 5.94% at the start of 2023, but this was not a uniquely American phenomenon. Equity risk premiums had seen an increase worldwide, especially in high-risk countries. Another noteworthy insight was that the risk exposure for individual companies is determined by their operational geography rather than their place of incorporation, which subsequently influences their weighted average equity risk premiums. This notion is particularly relevant for multinational corporations operating in various risk environments.

Preparing for the Wildcards: What Investors Should Look Out for in 2023

Investors need to be aware of potential wildcards that could affect asset performance in 2023. These wildcards include the 1) uncertainty surrounding inflation and 2) the possibility of an economic recession. Aswath Damodaran advises investors to stay informed and adaptable in the ever-changing financial landscape, preparing for potential opportunities and challenges. Vigilant monitoring of inflation’s impact on stocks, bonds, and other asset classes is crucial for successful navigation of the financial markets in 2023. Navigating the challenging financial landscape of 2023 requires investors to adopt sound investment strategies. Aswath Damodaran’s insights emphasize the importance of maintaining a long-term perspective and focusing on value investing. Investors should diversify their portfolios, spreading risks across different asset classes and geographical regions to minimize potential losses.

****

To delve deeper into the insightful analysis of Prof. Aswath Damodaran on the 2022 financial market and what it means for 2023, you can access the full webinar on LinkedIn or YouTube. If you’re interested in a copy of the presentation, we welcome your request via email at [email protected].

To further explore Prof. Damodaran’s key insights on the transformation of financial markets and businesses in 2022, consider browsing through the following list of his articles:

Data Update 1 for 2023: Setting the Table!

Data Update 2 for 2023: A Rocky year for Equities!

Data Update 3 for 2023: Inflation and Interest Rates

Data Update 4 for 2023: Country Risk – Measures and Implications

Data Update 5 for 2023: The Earnings Test

Data Update 6 for 2023: A Wake up call for the Indebted?

Data Update 7 for 2023: Dividends, Buybacks and Cash Flows

Each article provides a unique perspective on various aspects of the financial world in 2023, further expanding on the themes discussed in the webinar.

To learn more about the art of valuation explore out Valuation Training in partnership with Prof. Damodaran by clicking here.